carried interest tax reform

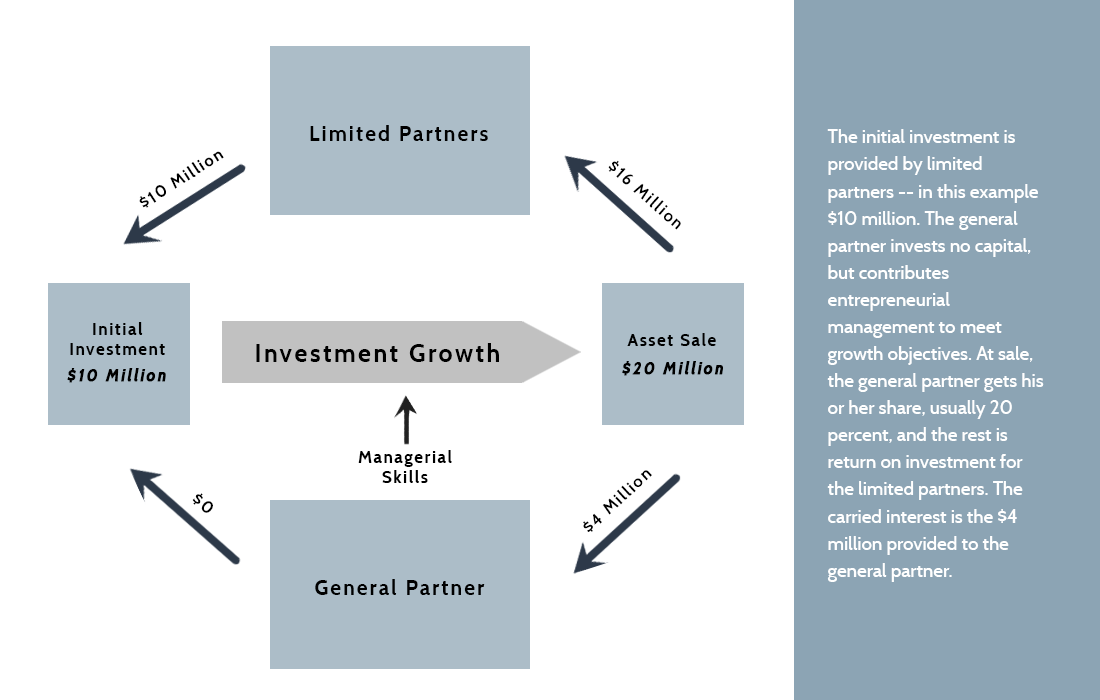

In this sense carried interest also referred to as promoted. This same loophole also fuels other predatory investing strategies that originate with private equity and real estate developers.

The Tax Treatment Of Carried Interest Aaf

The carried interest fairness act of 2021 would close the carried interest loophole and raise billions in tax revenue.

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

. Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM EDT Christina Wilkie. Olivier De Moor Patrick Fenn Lewis Kweit. A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders.

The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried interest to current inclusions of compensation income taxable at ordinary income rates in amounts that purport to approximate the value of a deemed interest-free loan from the. Senators Tammy Baldwin D-WI Joe Manchin D-WV and Sherrod Brown D-OH today introduced tax reform legislation to close the carried interest tax loophole that benefits wealthy money managers on Wall Street. The Outline of the 2021 Tax Reform Proposals Proposal which was agreed by the ruling coalition in December 2020 described that where the distribution ratio has economic rationality etc.

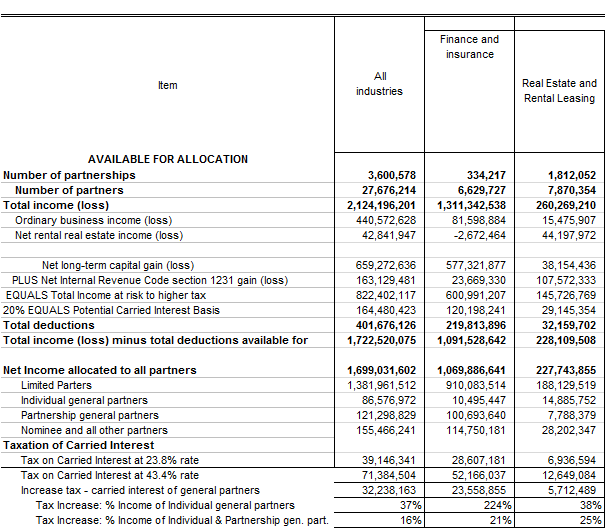

The carried interest tax loophole is an income tax avoidance scheme that allows private equity and hedge fund executives some of the richest people in the world to substantially lower the amount they pay in taxes. Washington DC Rep. In which the fund managers have an equity interest.

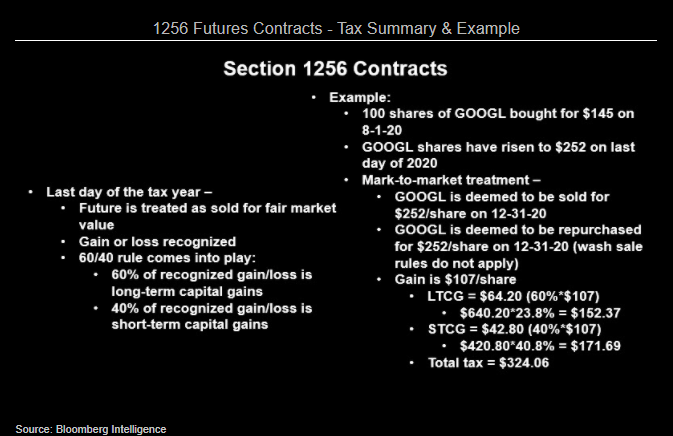

Hiking taxes on carried interest capital gains is one such proposal. Generally section 1061 operates to recharacterize long-term capital gains into short-term capital gains taxed at ordinary income. Others argue that it is consistent with the tax treatment of other entrepreneurial income.

Trump signed into law in late 2017 when the carried interest rules also known as promote in the real estate community were left mostly intact. 1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain. Republican lawmakers carried interest reform doesnt require proceeds from profits interests to be treated as ordinary income which would be real reform.

Enacted as part of the 2017 Tax Cuts and Jobs Act Section 1061 was the first step taken to curtail the preferential treatment of carried interests. The key change established in Section 1061 is that carried interests must be held for three years rather than the normal one-year period to qualify for long-term capital gains treatment. All of these types of investment firms have been accused of victimizing the public evading their tax obligations and benefitting from a preferential tax treatment.

Carried interest allows hedge funds to evade their tax obligations. Carried Interest Reform Under the Bill the concept of an applicable partnership interest API would be introduced in the Code which is generally intended to capture the profits interest aka carried interest held by the sponsors of private equity hedge venture capital and other investment funds that are structured as flow-through entities. For the Carried Interest that the fund managers receive from the partnership whose business is transfer of shares etc.

A proposed change to tax laws for partnerships has drawn stiff opposition from two advocacy organizations for builders. Carried interest that is not attributable to three-year property generally will be taxable as short-term capital gain for federal income tax purposes at. Sander Levin today reintroduced legislation to tax carried interest compensation at the same ordinary income tax rates paid by other Americans.

Since then at least four presidential candidates have called for carried interest to be taxed at. In 2014 Ways and Means Committee Chairman Dave Camp introduced a tax reform bill that would have raised rates on carried interest to 35 percent. Apr 3 2009.

The government released proposed regulations on July 31 2020 addressing the application of code section 1061 which was added as part of the Tax Cuts and Jobs Act of 2017 and is commonly referred to as the carried interest rules. Currently the managers of private investment partnerships are able to receive compensation for these services at the much lower capital gains tax rate rather. Earlier versions of Trumps tax reform proposal called for taxing all carried interest at ordinary income rates prompting a massive lobbying campaign by alarmed real.

Carried interest is the portion of an investment funds returns eligible for a capital gains tax rate of 238 instead of the ordinary income tax rate up to 37. Currently the carried interest loophole allows investment managers to pay the lower 20 percent long-term capital gains tax. Carried interest income flowing to the general partner of a private investment fund often is treated as capital gains for the purposes of taxation.

The carried interest loophole allows private equity barons to claim large parts of their compensation for services as investment gains. 1068 otherwise known as the Carried Interest Fairness Act of 2021 would boost taxes on real estate by requiring carried interest to be classified and taxed as ordinary income rather than as a capital gain. Carried interest is the share of a partnerships future profits that are paid to a general partner or fund manager as compensation for their performance of substantial services regardless of whether they contributed any capital to the entity.

Carried Interest and Other Tax Reform Highlights for Investment Funds and Asset Managers. Some view this tax preference as an unfair market-distorting loophole. By Keefe Borden.

By Keefe Borden. It was somewhat of a surprise in the final legislation President Donald J. Though there is a lot of inflammatory political rhetoric directed at the tax treatment of carried interest theres a limited.

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

The Realty Developers In Yamuna Expressway Have Been Warned By Authorities That No Flats Could Be Booked Or Construction Activities Carried Ou World Agra India

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Taxation Update On Final Regulations And Potential Legislative Changes Gray Reed Jdsupra

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

The Tax Treatment Of Carried Interest Aaf

Moving Toward More Equitable State Tax Systems Itep

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Gst Transitional Provisions Https Taxguru In Goods And Service Tax Gst Transitional Provisions Html Corporate Law Goods And Services Goods And Service Tax

Pin By Gst Suvidha Centre On Gst Online Accounting Software Accounting Accounting Services

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Benefits Of Outsourcing Payroll Infographic Outsourcing Payroll Financial Accounting

The Tax Treatment Of Carried Interest Aaf

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg